Die „Entdollarisierung“ ist eine Chance für die Vereinigten Staaten

Recently, the "de-dollarization" has soared to a recent peak of popularity in the international public opinion field. According to incomplete statistics, countries that seek to diversify currencies in international trade settlements have spread across five continents.

Picture: Popularity of search term "de-dollarization" (2019-2023)

The attitudes of various countries towards the US dollar are no longer enthusiastic, and the practical actions of "de-dollarization" are more intensive.

The reason lies in the current status of the United States in international trade.

The commonly called "dollar hegemony" is mainly reflected in the extraordinarily high percentage of US dollar settlement in international trade. Through its extremely high consumption capacity, the United States exports US dollars to the world. After other countries obtain US dollars in trade, they will move into U.S. dollar-denominated assets such as U.S. dollar bonds, so US dollars will partially flow back to the Federal Reserve, forming a perfect closed loop.

Looking back at the year of 2000, the United States accounted for 12.1% of the world's exports of goods, and was the largest trading partner of most developing countries; consequently, the US dollar became the only option.

Two decades later, however, this figure dropped to 8.1%, and the proportion of goods exported by developing countries rose to 45.9% of the global total.

This is the objective result of the development of global market competition. The decline of the United States' status in international trade means that the US dollar is no longer the only option for other countries.

However, the United States under pressure not only failed to adapt to the trend of global development, but "acted against the trend", practicing trade protectionism and promoting the wave of "anti-globalization".

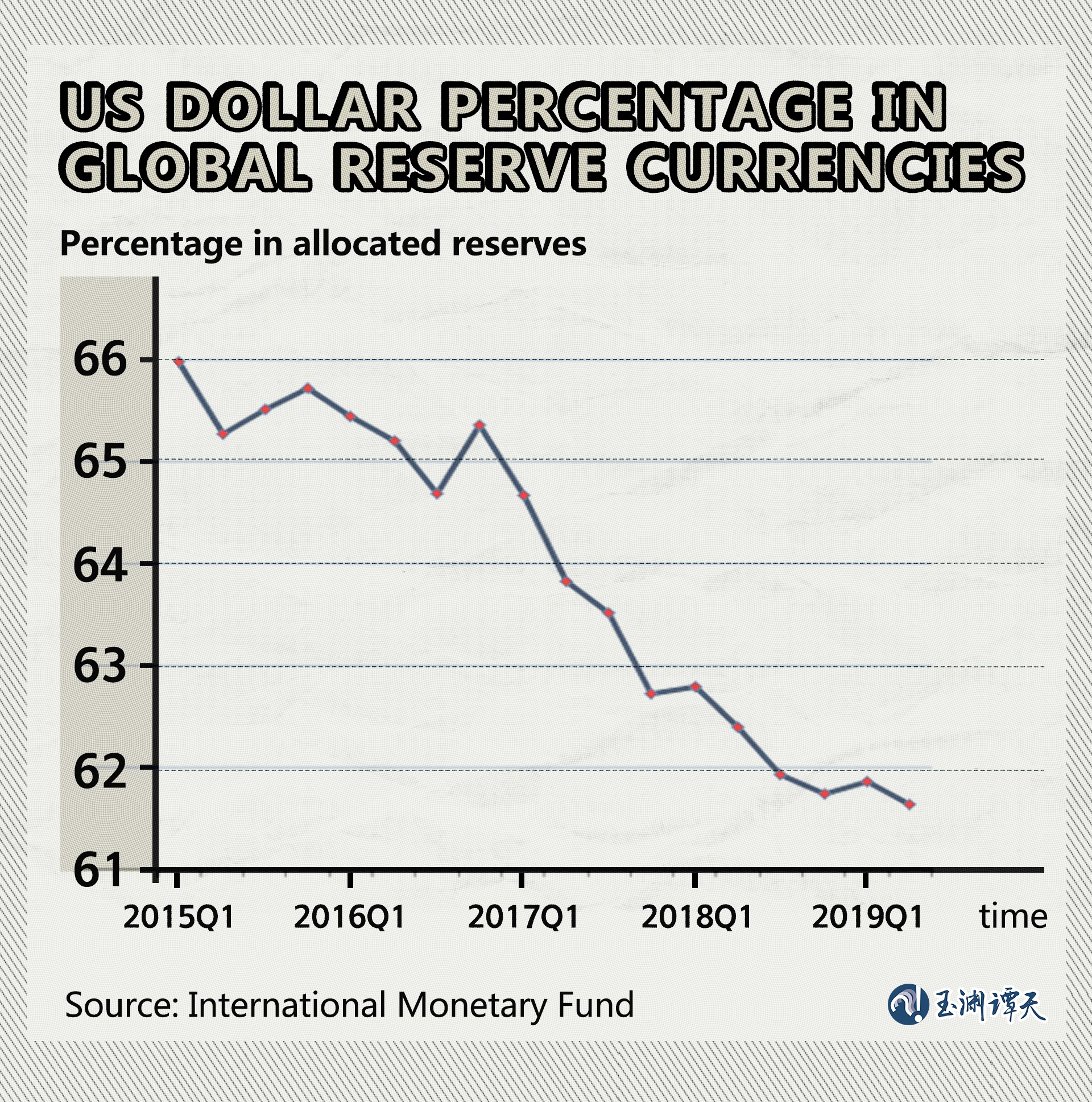

What about the reality? Other countries voted with their feet and made their own choices. Statistics showed that since former US President Trump launched a trade war in 2017, the proportion of global US dollar reserves has begun to decline rapidly. Protectionism only brought other countries one step closer to reducing the use of the US dollar.

What's more, according to the latest data released by the U.S. Department of the Treasury, the scale of U.S. Dollar bonds held by foreign investors continued to decline as well.

U.S. dollar bonds are a weathervane to observe other countries' confidence in the US dollar. After the Fed rate rise in 2022, central banks around the world dumped U.S. dollar bonds. More than 50% of the countries holding U.S. dollar bonds collectively reduced their holdings during the U.S. interest rate rise cycle for the first time in the past two decades.

The United States previously used various "financial" means to sanction and incite unrest. Now, such means started to backfire on the United States, causing panic in the market and accelerating the loss of confidence.

Lately, as Treasury Secretary Janet Yellen deeply reflected on the U.S.'s self-defeating moves: economic sanctions against foreign countries will endanger the dominance of the U.S. dollar. On April 20 local time, in Yellen's most extensive speech since she took office, she also mentioned a Chinese saying that the earth is big enough for China and the United States.

What can be done to accommodate and be accommodated by others should considered by the United States in face of the "opportunity" of "de-dollarization".